All You Need to Know About Point-of-Sale (POS) Terminals

Point-of-Sale (POS) terminals have become a vital part of retail business management frameworks for many industries. From supermarkets and convenience stores to liquor and tobacco stores – all the retail outlets and businesses use terminal POS systems.

Over the years, POS terminal machines and technologies have drastically advanced. For instance, in the case of the preliminary POS terminal, credit cards were used to make payments. Later, contactless POS terminals were introduced that leveraged mobile wallets to serve the purpose. Currently, retailers have numerous variety of POS terminals to get going with their regular business transactions.

What is a Point-of-Sale (POS) Terminal?

A point-of-sale (POS) terminal is a type of hardware that helps process credit and debit card payments. It has an inbuilt POS software to read the magnetic stripe/chip of the cards customers use for making payments. There are various types, functions, and features associated with POS terminals.

However, as simple as it sounds, the functioning of a POS payment terminal involves a speedy yet detailed process.

How Does a Point-of-Sale (POS) Terminal Work?

POS terminals function as a computer. It’s meant to read, identify, and process the card data of the customers. Using a card reader, the terminals read the magnetic stripe of a credit/debit card and confirm the availability of funds in the associated bank account. Once that’s done, the funds are transferred from the customer’s account to the merchant’s account. After the transaction is completed, the terminal either prints a receipt or sends a confirmation mail/SMS to the customer.

An all-in-one POS terminal stores the relevant payment details such as the customer’s account number, date of transaction, and purchase amount, to name a few. This data can be further used to generate several business-specific reports for different operations.

- Point-of-Sale terminals can process card payments in 3 ways:

- Reading magnetic stripes when the cards can be swiped and processed.

- Reading microchips when the cards can be inserted and processed.

- Reading EMV chip cards when the cards can be tapped (NFC) and processed.

What is POS Terminal System Integration?

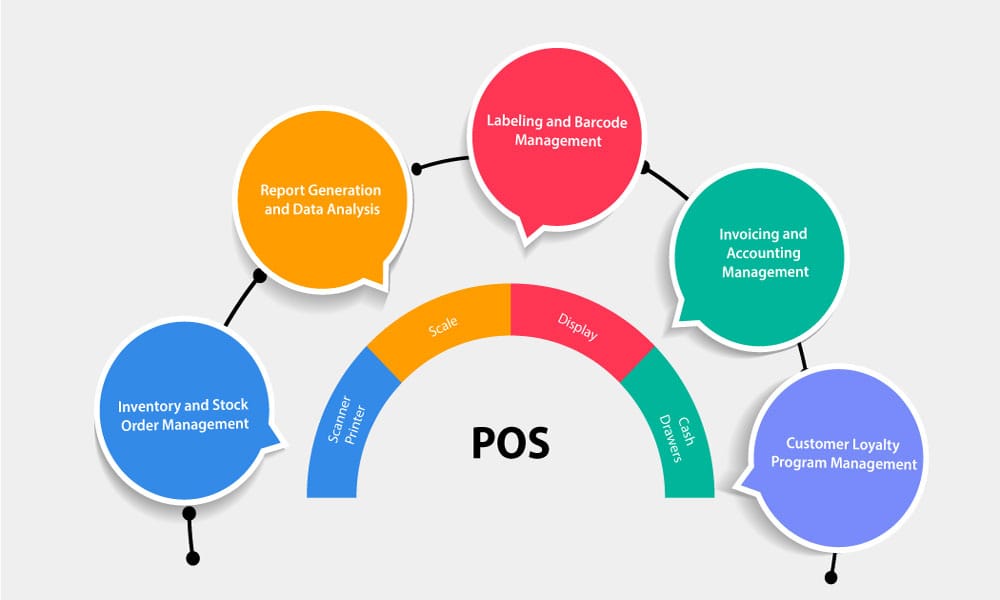

All-in-one Point-of-Sale (POS) terminals come with features that facilitate total integration with a wide range of POS hardware and software.

Hardware Components

During checkouts, there’s a lot going on when the customers are ready to pay and leave. The entire customer journey from billing to closing the purchase involves the role of different types of POS hardware components. Apart from the payment terminals, these equipment are responsible for carrying out item and invoice management.

1. POS Barcode Scanner

POS barcode scanners are used to scan UPC (Unique Product Codes) that trigger the inclusion of the items purchased into the billing system,

2. POS Weighing Scale

POS weighing scales are connected to the POS system software. Once the products are weighed, the appropriate price is directly fed into the billing system.

3. POS Touchscreen Display

Modern-day retail businesses use POS touchscreen displays for better customer checkout management.

4. POS Receipt Printer

Once the Point-of-Sale terminal processes and completes the transactions, the POS receipt printer generates payment receipts for the merchant and the customer.

5. POS Cash Drawers

For enhanced security and automated fund storage, there are POS cash drawers that function based on selective access.

All of these hardware components, along with the POS terminals, constitute a complete POS system. But yes, the driving force behind this system is the POS software!

Software Features

Point-of-Sale (POS) terminals aren’t only about payment processing. The presence of an integrated POS software brings a lot of productive and beneficial features into play. Here are some major software features you can expect with your POS system:

- Inventory and Stock Order Management

- Report Generation and Data Analysis

- Customer Loyalty Program Management

- Labeling and Barcode Management

- Invoicing and Accounting Management

What are the Main Types of POS Terminals?

Whether it’s a hybrid, conventional, or fully touchscreen POS terminal – it can be further categorized based on its connectivity and other functions. Here are the major types of POS terminals:

GPRS/PSTN POS

In the early POS days, retailers used wired terminals with GPRS connectivity. Now, POS terminals with SIM-enabled GPRS connectivity are frequently used. This type of terminal is bigger in size and comes at the most affordable rates. Small businesses with modest budgets can opt for such payment terminals.

mPOS

In order to overcome the wired limitations of conventional terminals, the mPOS was introduced. Known for being slim, sleek, and portable, the mPOS (Mobile point-of-sale) is the ultimate solution for obtaining mobility while accepting payments. All you need to have is a smartphone and an app to get going. Today’s mPOS devices come with multi-connectivity options such as GPRS, WiFi, 3G, and NFC technology.

Android POS

POS systems and terminals inbuilt with Android operating system – Yes, you heard it correctly! Now, the market is filled with numerous Android POS options having bigger displays and faster user interfaces. Android POS terminals can let you install relevant applications instead of relying on a smartphone to run these apps. If you wish to enhance your customers’ shopping journey, these devices will add to their convenience and your store’s aesthetics.

What are the Major Benefits of Having All-in-One POS Terminals?

- Secure Payments and Fraud Prevention

- Item Tracking and Management

- Data Analysis and Management

- Better Customer Experience

- Faster Billing and Checkouts

- Report Generation

- Smoother Store Operations

- Automated Customer Loyalty Management

- Integrated Software and Hardware Solutions

Install PtechPOS POS Terminals at your store to get the best point-of-sale features in the United States. Get in touch with us TODAY!